According to a notification issued by the Ministry of Poverty Alleviation and Social Safety, the Administrator General Zakat has notified the ‘Nisab of Zakat’ for 2023 (1443-44 A.H.) at Rs. 103,519, which will be deducted from Savings, Profit and Loss Sharing, and similar Bank Accounts.

The notification, however, added that no Zakat at source deduction shall be made if the amount standing to the credit of an account is less than Rs. 103,159 on the first day of Ramadan-ul-Mubarak, which has been designated as the ‘Deduction Date’ for Zakat.

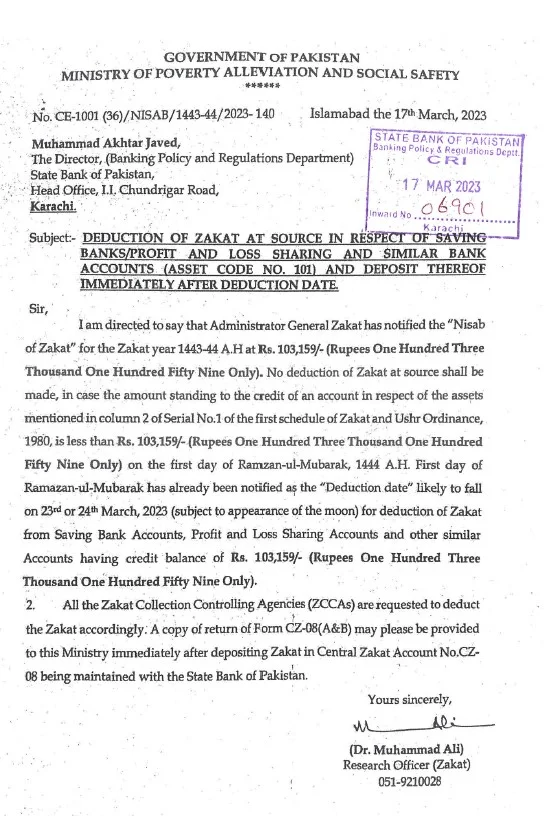

This is a copy of the notification:

According to a notification issued by the Ministry of Poverty Alleviation and Social Safety, the Administrator General Zakat has notified the ‘Nisab of Zakat’ for 2023 (1443-44 A.H.) at Rs. 103,519, which will be deducted from Savings, Profit and Loss Sharing, and similar Bank Accounts.

The notification, however, added that no Zakat at source deduction shall be made if the amount standing to the credit of an account is less than Rs. 103,159 on the first day of Ramadan-ul-Mubarak, which has been designated as the ‘Deduction Date’ for Zakat.

It is important to note that Ramadan is expected to fall on March 23rd or 24th, 2023, depending on the sighting of the moon, and that this will be the Deduction Date of Zakat for the year 2023. (1443-44 A.H).

On the first day of Ramadan, Zakat will be deducted from Savings Bank Accounts, Profit and Loss Sharing Accounts, and other similar Bank Accounts with the specified minimum balance, i.e. Rs. 103,519.

In the meantime, all current bank accounts will be exempt from Zakat deduction.

Furthermore, according to the Nisab set by the government, Zakat will be deducted at a rate of 2.5% on the total balance in the bank account.