The Pakistan Meteorological Department (PMD) reports that the potent cyclone Biparjoy is...

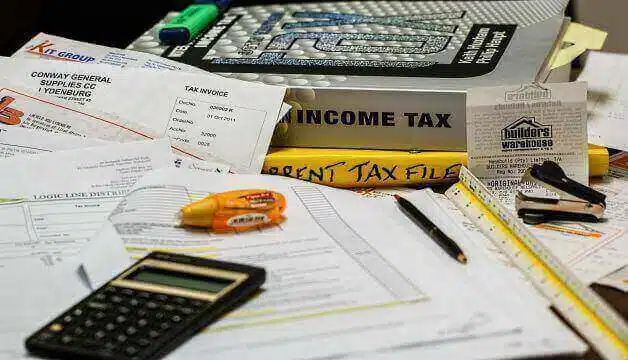

The federal government has proposed an exemption from income tax for people...

Wordle Answer Today 11 june 2023, Wordle #722 answer: Word puzzles have...

The Sony Xperia Pro-I II, which will replace the Sony Xperia Pro-I,...

In terms of production and sales, Honda Atlas Cars Limited (HACL) is...

With her most recent photo shoot, actress Laiba Khan made sure to...

The stunning and glitzy actress Kinza Hashmi never ceases to captivate audiences...

Saeeda Imtiaz, a stunning actress and model, has once again left viewers...

Aamna Sharif, a captivating Indian television actress, recently graced the seaside with...

The stunning new Bulgari Hotel in Rome had a glamorous gala opening,...

The National Disaster Management Authority (NDMA) of Pakistan stated during a special...

The fiscal budget for 2023–2024 has been released, which is fantastic news...

Shahtaj Khan, whose Instagram feed is a seductive blend of sophistication and...

A Pakistani fan he met while competing in the World Test Championship...

Nomaika Satti, wife of ARY News anchorperson Ashfaque Satti, has made a...

According to the Pakistan Meteorological Department (PMD) on Thursday, a cold wave...

Junaid Safdar, the son of Pakistan Muslim League-Nawaz (PML-N) Maryam Nawaz, announced...

In front of startled tourists, a 16-foot crocodile attacked a zookeeper, but...

THIS is the horrifying moment a spinning amusement ride fell to the...

A MAN who broke into a zoo to try to kidnap a...

The federal government has decided to increase the Naya Pakistan Certificates' (NPCs')...

The aerospace technology firm SpaceX reportedly sold the Bitcoin it had accumulated...

Sam Bankman-Fried, the creator of FTX, was ordered to jail on Friday...

On Friday night, Anthony Joshua and Francis Ngannou square off in yet...

ESPN has declared the passing of renowned broadcaster and journalist Chris Mortensen....

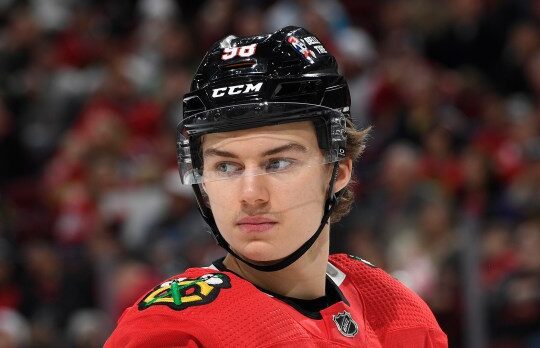

When Connor Bedard, an NHL breakout player, joined the Chicago Blackhawks in...

A statement from his loved ones on X read: "With heavy hearts...

Early in 2024, news anchor Will Reeve ignited engagement rumors with his...

Actress and model who was repairing her automobile on a hard shoulder...

In the dynamic landscape of web development, businesses seeking to establish a...

A new feature has been added to the well-known messaging software WhatsApp...

Ethiopia recently unveiled the Itel S23+. The most recent smartphone from the...