You haven’t yet submitted your yearly income tax return. The deadline is in two days, so complete it as soon as you can. The Federal Board of Revenue’s (FBR) official sources state that the deadline to file your income for the tax year 2022 is September 30, 2022.

Before we go into the specifics of the procedure, it is crucial to note that everyone in Pakistan who earns PKR 600,000 or more annually is required to file their tax returns. You’re in luck if you believe your yearly income exceeds this amount and you haven’t filed taxes yet. We have provided a comprehensive tutorial on how to file taxes in Pakistan that will walk you through every step of the procedure. Additionally, filing income taxes in Pakistan has various advantages, including tax breaks, duty exemptions, and more.

How to file tax returns in Pakistan 2022

Online income tax return filing has gotten a lot simpler. By going to the Federal Board of Revenue website, everyone can now quickly file their taxes online. Following are the steps for filing tax returns in Pakistan.

HOW TO LOGIN TO IRIS PORTAL AND FILE INCOME TAX RETURNS

- File income tax returns by first logging into Iris. Iris is an online portal where income tax return is filed. Enter your username and password

- In case you forget your password, click on ‘Forgot password’

- Once you have successfully logged into the portal, click on ‘Declaration’ menu on top of the portal

- Select the tab under Forms which states: ‘114(1) Return of Income Filed Voluntarily for 1 Year)’

- Click on the Period tab, where you have to enter the Tax yea

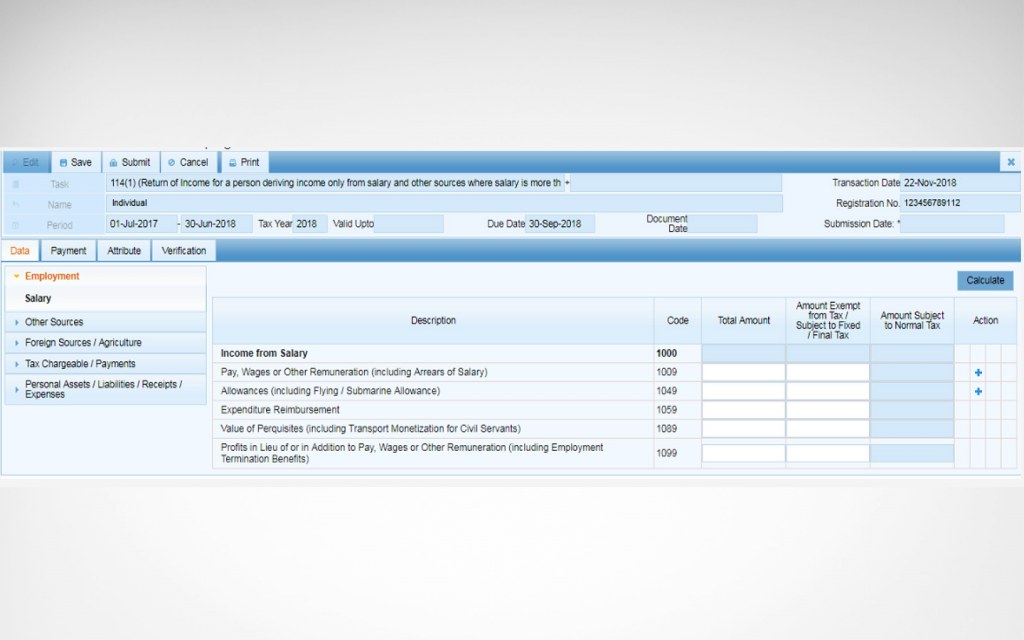

EMPLOYMENT SECTION

- Now, a page will open up, where you click on Employment section

- Select Salary Tab

- Enter the annual income in salary in the Total Amount section

- If the salary you have includes the amount that is exempted from tax mention it under the heading ‘Amount exempt from tax’

- Once you are done click on Calculate button

- Provide total tax, amount exempt from tax and subject to final tax in input fields and then click on Calculate button

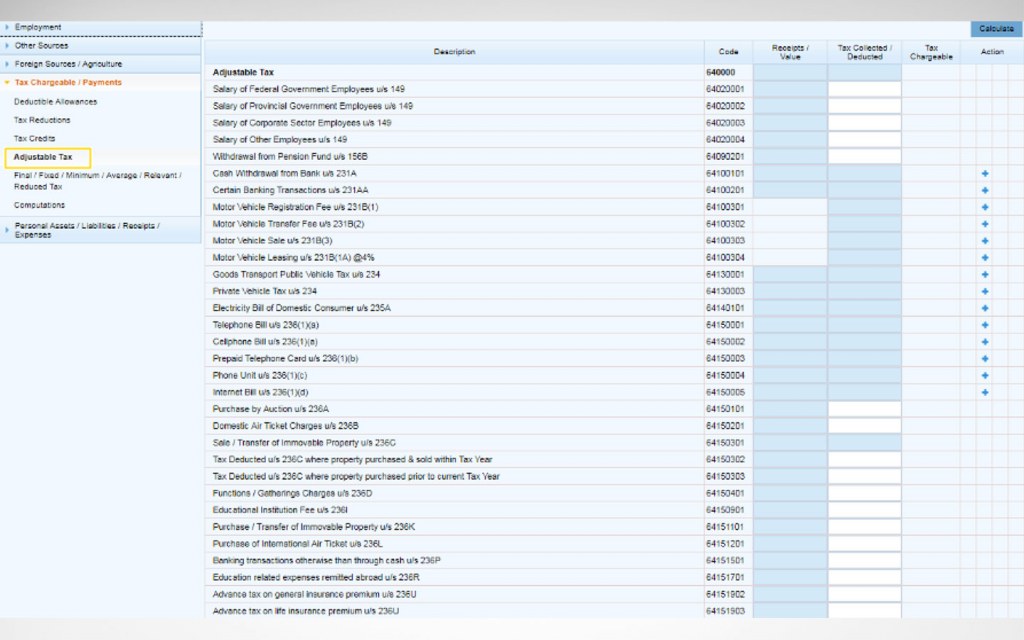

ADJUSTABLE TAX AND THE AMOUNT OF TAX DEDUCTED

- Click on Tax Chargeable/Payments tab and select Deductible Allowances tab where any amount that is deducted in the name of Zakat or charitable donations should be entered

- Fill out Tax Chargeable, Tax Reductions, Adjustable Tax and Tax Credits field

- On Adjustable Tax screen you need to fill out the details of the taxes that have already been taxed or charged to you during your tax year

- If you are a federal government employee, then enter tax amount against 64020001 code

- For provincial government employees, enter the tax amount against 64020002

- If you are a corporate sector employee, then enter your tax amount against 64020003 code

- You can also adjust the tax deducted by your bank on various sections like when you withdraw cash from bank in 64100101. Other banking transactions like any bonds or savings should be entered in the code 64151501.

- You can also adjust the tax deducted by your bank on motor vehicle registration fee, transfer fee, sale and leasing against their respective codes

- A dialogue box shall appear asking for vehicle details like E&TD Registration No. and provide further details related to its make, model and engine capacity. Once you are done with it then click on Calculate Tab button

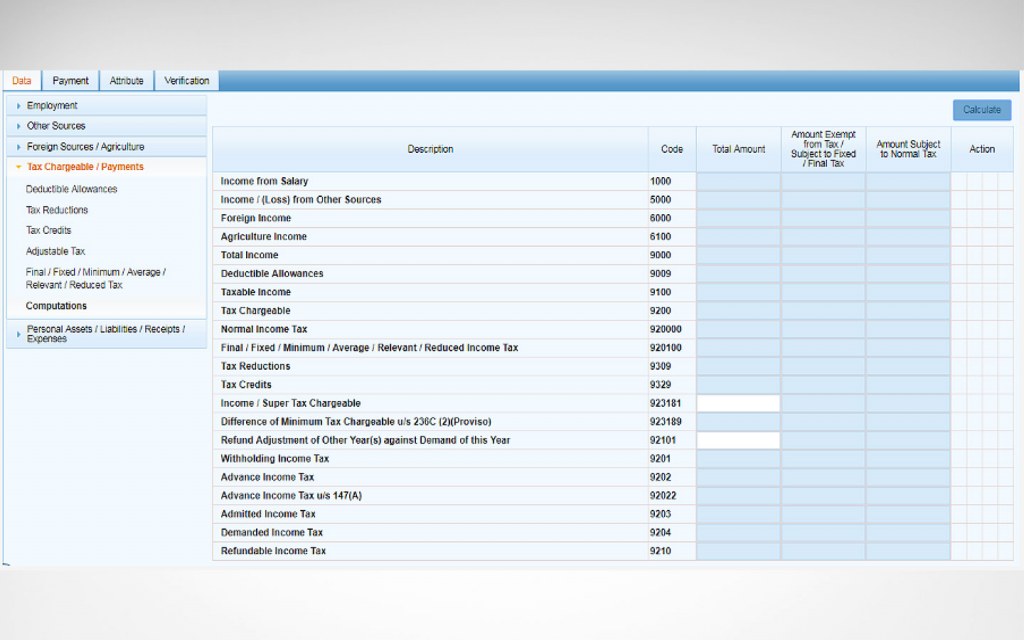

TAX CHARGEABLE/PAYMENTS

- Select Tax Chargeable/Payments tab and you will see all the details of your income and chargeable tax

- Check out the tabs Admitted Income Tax and Demanded Income Tax

- If you find any amount against the Demanded Income Tax tab then you must pay it and attach relevant CPR

NET ASSETS

- Click on Personal Assets menu to provide information about your assets

- Enter the total amount for the previous year net assets and also of the current year

- Enter the amount of annual income in the inflows and outflows field

- Click on the Calculate button after filling out all the details

- The ‘Unreconciled Amount’ must be zero when submitting income tax returns

PAYMENT FOR DEMANDED TAX

- When you have paid the Demanded Tax either through Alternative Delivery Channel (ADC) or through cash by visiting any authorized branch of National Bank of Pakistan, then you need to submit the details of your returns in the following steps

- Select Payments tab and click on the + sign on top right corner

- A dialogue box shall appear asking for payment details

- Enter CPR no. Amount Code or Paid Amount and click on search option

- The entire list of details of your payment will appear, click on the OK button and then save

VERIFY INCOME TAX RETURN FORM AND SUBMIT IT

- Once you have added and calculated all required fields, you should now verify your identity.

- Your name and registration number shall already be populated

- Enter the verification pin that was given to you at the time of registration and click on Verify Pin tab

- Once you are given the details, you can now file income tax returns by clicking on the Submit tab

This was a thorough manual on how to submit Pakistani income tax forms. We hope this information was useful to you. Send us an email at blog@zameen.com if you have any inquiries or comments. You might also enjoy reading our blogs on the federal budget for this year and the income tax slabs for fiscal year 2022–2023.

Read More: FBR extends tax return filing date till October 31