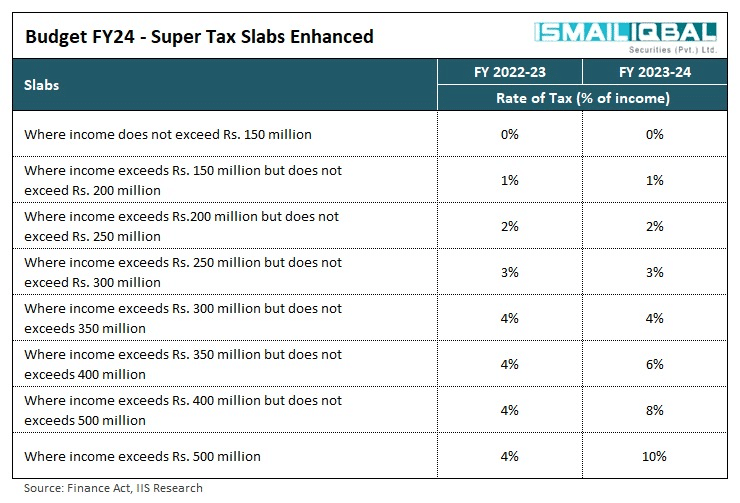

For the fiscal year 2023–2024 (FY24), the government has altered the Super Tax slabs and made significant changes for those with higher incomes.

Individuals with incomes under Rs. 150 million, between Rs. 150 and 200 million, between Rs. 200 and 250 million, between Rs. 250 and 300 million, and between Rs. 300 million and Rs. 350 million continue to pay the same tax rates for both FY23 and FY24: 0%, 1%, 2%, 3%, and 4%, respectively.

On the other hand, for FY24, the tax rate for individuals with income between Rs. 350 million and Rs. 400 million will rise from 4% to 6%.

In comparison to the previous 4 percent rate in FY23, individuals with incomes between Rs. 400 million and Rs. 500 million would now pay an increased tax rate of 8 percent for FY24.

Similar to this, the tax rate will increase for people whose income exceeds Rs. 500 million from 4 percent in FY23 to a hefty 10 percent in FY24.